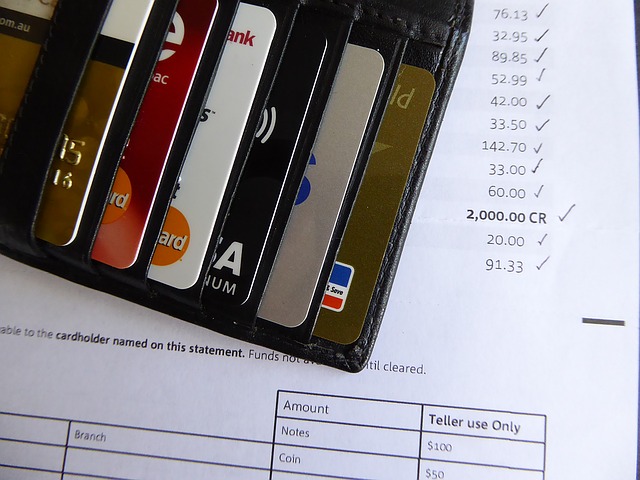

If you are receiving harassing phone calls from your creditors, you may benefit from debt consolidation. However, it won’t happen overnight. You can improve your situation if you make plans for the long term and educate yourself about your different solutions. The paragraphs here are going to teach you what you need to do if you wish to consolidate your debts.

Consider your best long term options when choosing a company to consolidate your debts. Make sure that they can help you tackle your current issues and those that may arise in the future. Some provide services that help you avoid these situations later.

Avoid choosing a lender that you don’t know anything about. Loan sharks are there to hurt people when they need help. When you want to consolidate your debts, find a reputable lender who offers a competitive interest rate.

Before considering debt consolidation, review your credit report. You need to know what got you in your situation. By doing this, you will help prevent yourself from making the same financial mistakes you made before.

When you’re thinking about debt consolidation, consider how you first put yourself in this position. You don’t need to run into this again five years down the road. Be honest with yourself and learn what made you find this situation in order for you to never experience it again.

Credit Rating

Know that getting debts consolidated isn’t going to do anything to your credit rating. In effect, with debt consolidation, you will be paying off your debt at lower interest rates and there are only a few cases where your credit rating would be impacted. Staying current is the most important goal.

Try and confirm that you’re working with qualified debt consolidation counselors. Is there an organization that they are licensed and certified with? Are they backed by a reputable company that will be there if something goes wrong? This can help you sort out the good companies from the bad.

Although using debt consolidation companies can really help, it is important that you learn if they are reputable. If it sounds too good, then it probably is. Question the lender closely, and don’t proceed until you feel comfortable with the information you have received.

If you’re looking into debt consolidation, you’ll need to carefully determine which debts need to be consolidated. If you have zero interest on something right now, then consolidating that loan onto a card with any interest rate higher doesn’t make sense. Look at each loan individually to ensure you are making the best decision of whether to include it in your debt consolidation.

If you’re not able to get money from places, you should see if a loved one is willing to help. Be sure that you be specific on when and how you will repay them, and keep your promise. You want to avoid hurting a relationship with someone close to you.

If you have been paying into life insurance, it may help you out. You should think about cashing your policy so you can pay your debt off. Contact your insurance agent to find out how much you could get against your policy. Your policy may have a cash value which you may borrow to help pay debts.

A debt consolidation agency should use personalized methods. A professional who presents you with a few options without taking the time to learn anything about your situation is not a good choice. Your counselor should take the necessary time to offer you a personalized plan.

Debt Consolidation

When you understand the process, debt consolidation can be a blessing. Do plenty of research on different debt consolidation professionals before deciding to use their services. You need to start to implement the things you’ve just learned about debt consolidation in order to make it work for you.

If you get a low interest rate credit card offer, think about using it to consolidate other obligations. You may be able to save money on interest charges this way. Once you have did a balance transfer, pay it off as quickly as possible.