Nearly anyone can eliminate debt quickly and simply using debt consolidation. Even though all your financial issues won’t be solved overnight, it can make your life much easier through one simple monthly payment that will pay all your creditors. If you find getting out of debt to be an uphill battle, read on for some ways to make the debt mountain less steep.

Consider the long term when picking out the debt consolidation business that’ll be helping you. You want to fix your current issues, but you need to know whether a company can work with you as time goes on, as well. Some organizations offer services to help you avoid financial problems in the future.

Never select a debt company simply because they claim non-profit status. Non-profit does not equate to good business practices. Be sure to check out the BBB online to find reviews and ratings of any debt consolidation company you are considering.

Make sure you examine your credit report very carefully before proceeding with a debt consolidation plan. It is important to figure out what happened to get you in the position you are in now. That way, you are unlikely to make the same errors again after you have straightened out your finances.

Do you have life insurance? If so, consider cashing in your policy and using the funds to pay down your debt. Contact your insurance agent to find out how much you could get against your policy. You may be able to borrow a bit of what you’ve invested to help you pay your debts.

Once you decide to allow a debt consolidation counselor to help you, be sure you inform your creditors. These people might try to assist you in this process, and they may even talk about alternative arrangements. It’s critical to let them know; otherwise; they might not ever know you are talking to other parties. Information that you are trying to get things under control might help.

Credit Card

When you are looking into debt consolidation options, don’t assume that a company advertised as non-profit is completely worthy of your trust or that they won’t be charging you a lot. Even scammers will use this term to try to suck you into their web with loan commitments and interest rates that are way too high. Try to seek out a personal recommendation or look up companies on the BBB website.

If you’re struggling with high interest rates on your credit card, look for a card with a lower rate that you can consolidate all your debts with. You may be able to save money on interest charges this way. When you’ve consolidated your debt on a single credit card, try paying that off prior to the introductory interest offer expiring.

When thinking of using a company to consolidate your debt, you should remember to research them and go over a few different reviews of that place. If you do this, you can make the best decision for your financial future.

If you are looking to get out of debt quickly in a simple manner, then you probably should be interested in debt consolidation. You can combine all your payments and get rid of debt in a quicker manner. Use what you’ve learned here, and put it to work to get out of your financial situation.

Figure out how to formulate your own consolidation interest rate. Fixed interest rates are the best. This keeps your payments stable for the term of the loan. Adjustable plans can be deceiving. Often, they’ll lead to you paying much more for your debt over time.

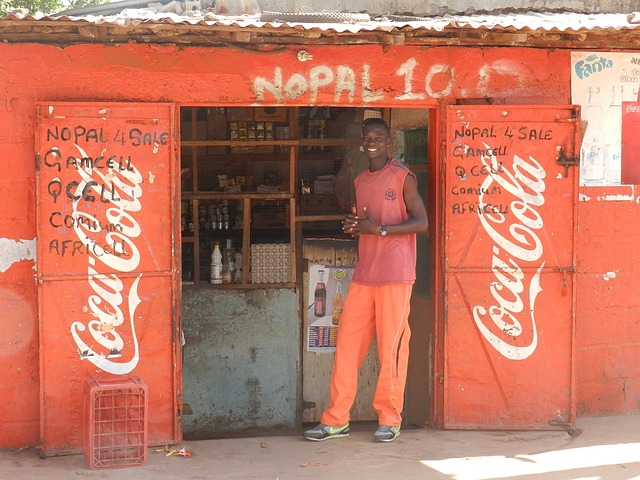

There are tremendous opportunities for small businesses and social entrepreneurs to support their communities through community foundations, donor advised funds and other means of giving back. Find the neighborhoods in

Portland, Oregon where you can make the most impact on children in the community.