Bank cards can be frustrating for quite a few people. Just like anything else, it’s easier to turn credit cards into a hassle-free financial venture if you have proper advice. The below article gives you many tips that will help you deal with bank cards.

Avoid using bank cards to buy something that is more than you would ever dream of affording with cash. If it is something that is going to cause you financial difficulty, you are better off avoiding the purchase.

When looking over your statement, report any fraudulent charges as soon as possible. The sooner you report it the sooner you give credit card companies and the authorities to catch the thief. This will also allow you to be sure that you aren’t responsible for the charges they made. You can report the majority of fraudulent charges with a simple email or phone call to the credit card company.

Before opening a store credit card, look into your past spending and make sure that it is high enough at that store to warrant a card. Every credit inquiry impacts your credit score, even if you do not end up getting the card after all. Racking up a list of inquiries from several different retail stores can cause your credit score to drop.

Read the small print. We have all been pre-approved for one card or another, but it’s important to understand all of the specifics about that card before accepting it. Understand the interest rate you will receive, and how long it will be in effect. Make sure to find out about grace periods and fees.

There are often great bonuses for accepting a new card. It is important to totally understand the specific terms laid out by the credit card company since you must follow their guidelines to qualify for a bonus. One of the most common terms is that you spend a set amount of money in a set period.

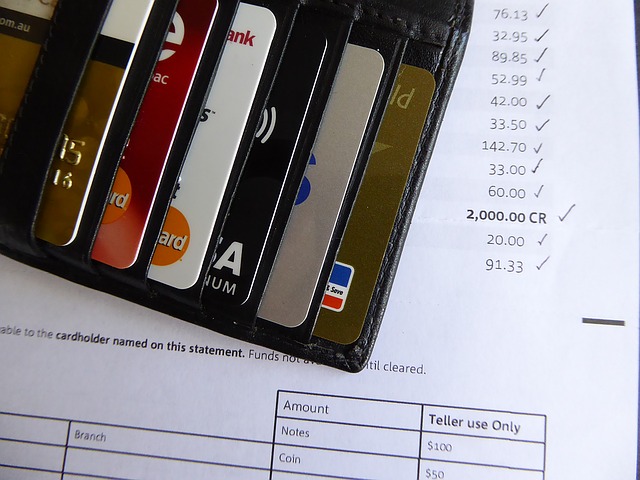

Credit Card

Plan a budget you will have problem following. Simply because a card issuer has given you a spending limit, you should not feel obligated to use the entire amount of credit available. Be aware of how much you can pay monthly so that you can do that consistently and avoid those interest charges.

Always make any credit card payments on time. You should always be aware of when any credit card bills are due so that you do not incur any fees. Additionally, most companies will increase the interest rate on your credit card, which means an increase in the cost of every purchase you put on that card thereafter.

Consider the different loyalty programs offered by different companies. Choose a credit card whose loyalty program offers you something valuable. If used correctly, this can supply you with a bit of extra income.

Do not have a pin number or password that would be easy for someone to guess. Common information like names, or birthdays are easy to guess and should be avoided.

Sign credit cards as soon as you receive them. Many people don’t do that, their cards get stolen, and cashiers do not realize the theft. Many retailers will always verify a customer’s signature matches the one on the back of their credit card in order to reduce the number of fraudulent transactions.

Do not leave any blank spaces when you are signing a receipt in a retail store. If you are not giving a tip, put a mark through that space to avoid someone adding an amount there. Make sure your statements match the charges you make.

It is often frustrating to deal with the hassle of a credit card company. Choosing a good card is easier with research and advice. Use the information presented here to help you select the right card and use it wisely.