The current economy sucks, and many people are feeling the pain. Though you might not be able to be rich overnight, there are some simple ways you can live well by arranging your finances. The following article is going to provide you with this crucial information.

If the timing is not good for you, then do not sell. If you’re getting good money from a certain stock, leave it alone for a period of time. Carefully study your portfolio, and decide which stocks you should sell and which ones you should hold on to.

If you buy protein in large quantities, you will reduce both your bills and number of grocery trips. Buying in bulk is generally less expensive if you use everything you bought. Save time and energy by dedicating one day to cooking meals for the week utilizing your bulk meat purchase.

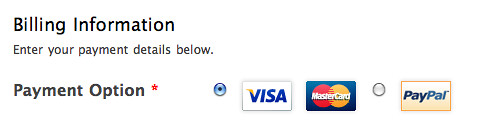

Avoid incurring debt for the best personal finances. Granted, there are certain debts that are necessary. However, there is rarely suitable justification for using a credit card to make daily purchases. The less you have to borrow, the less hard-earned money you will lose to interest and fees.

While you are working to fix your credit, your credit score may decline. Don’t worry too much about this if you have done nothing wrong. You’ll observe your score going up over time, so long as your credit report is consistently receiving positive items.

If you are unsuccessfully trying to pay off the balance on a credit card, refrain from making any new charges with it. Eliminate any unnecessary expenses and find another payment method to avoid maxing out your credit cards Before you begin charging again, pay off the current balance so you don’t get in over your head.

Frequent Flier

In order to build good credit, you should be using two to four credit cards. Using only one card means it will take a long time to build a good credit score, and more than four cards means you cannot manage your finances efficiently. Start out slow with just two cards and gradually build your way up, if needed.

A great way for frequent travelers to be rewarded for their travels is through a frequent flier plan; most airlines offer these programs. Many credit card companies offer rewards made on purchases that can be redeemed for free or discounted air fare. Frequent flier miles can also often be redeemed at a variety of hotels for free rooms or discounted stays.

As was explained above, you may not have enough money to be rich but there are still some ways to live comfortably. Remember, a person doesn’t need to be a millionaire to be happy, he only needs the ability to live his life in a financially savvy way.