Bank cards make life difficult for many people. Just like anything else, it’s easier to turn bank cards into a hassle-free financial venture if you have proper advice. The article below discusses some of the best ways to use credit responsibly.

It is a good practice to have more then one credit card. Not only does this increase your credit ranking, but when you pay every month, you also increase your line of credit. Having tons and tons of credit cards, however, will not look very good to lenders.

Credit Card Accounts

Avoid using credit cards to buy something that is more than you would ever dream of affording with cash. If it is something that is going to cause you financial difficulty, you are better off avoiding the purchase.

Do not close any credit card accounts before you are aware of the impact it will have on you. In some circumstances, closing credit card accounts can negatively affect the credit report, which is something that should be avoided. Choose to keep the accounts that you have had open the longest that make up your credit history.

If you want a card but don’t have credit, you might need a co-signer. This can be anyone who trusts you, like a relative or close friend. They are required to state their willingness to assume responsibility for outstanding balances if you fail to pay. This is one method that is effective in helping individuals to obtain their first card so that they can start building credit.

If your mailbox is not secure, do not request charge cards through the mail. Many scammers have admitted to stealing cards that were in mailboxes with no locks on them.

It is a good practice to have more then one credit card. This helps improve your credit score, particularly if you can pay off the cards each month in full. However, if you open more than three, it may not look good to a lender when they pull your credit bureau report.

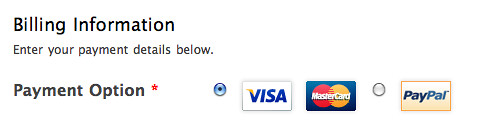

Card Information

Be careful when you use bank cards online. Before you enter any of your credit card information, make sure the site you are using is secure. You can set your browser to notify the security settings for each website you visit. In addition, you should ignore any emails that ask you for your card information, because these are attempts to collect your information.

As was stated earlier, charge cards can be a source of great frustration. However, if you do your homework, choosing the right card and using it properly is easy. Use this article’s suggestions and enjoy life with a credit card that much more.

If you see a charge on your card that isn’t yours, talk to your credit card issuer immediately. If you do so, it will be more likely that the thief is caught. Additionally, you will avoid being responsible for the charges themselves. It is fairly simple to report erroneous charges, either with an email or phone call to the credit card company.