There is no time like the present for taking control of your personal finances. Continue on to the article below for some excellent personal finance tips that you can incorporate into your own life. An advanced degree is not necessary for you to learn how to increase your ability to save and live better. Even a few small ideas can have big benefits.

When you do Forex trading, keep an eye on the trends. You must stay up with the current trends. That way you will be able to make the right buying and selling choices. Don’t sell in a swinging market of any kind. Have a very clear goal in mind if you are choosing to move your money before the trend has fully played out.

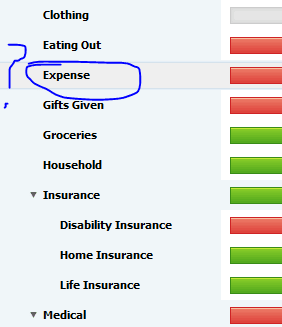

To understand how you spend money, keep a journal listing every cent you spend for one week. Having said that, it is useless to write this down into a small notebook that you usually keep out of your sight. If you list your expenses in a noticeable area, such as on a marker board, this may help. You will look at it every day and be reminded of what you need to do.

Watch the Forex forums to identify new trends. You need to have your finger on the pulse of the forex markets, so you can take advantage of market inefficiencies. Make sure that you do not sell during an upswing or a downswing. If you don’t ride a trend to the end, you should reevaluate your goals.

Purchasing bulk orders of lean protein meats can save you both time and money. It will always save you money if you can buy in bulk as long as you are able to use all that you purchased. A lot of time can be saved by cooking a week’s worth of meals all at once.

By practicing patience in your personal finances, you can save a significant amount of money. A lot of people will rush out to buy the newest model or latest edition of electronic products as soon as they hit the shelves. If you wait some time the price will go down and you will save a lot of money. This way, you will have extra money to spend on other things.

Big lifetime purchases include buying a car and a home. At first, the payments for large items will mainly go towards interest expenses. You can pay these items faster simply with an additional payment every year, or you could make use of your tax refunds for paying the balance.

When traveling abroad, save on eating expenses by dining at establishments favored by locals. Most likely, the restaurant in the hotel, and the restaurants located in tourist areas will be expensive, so look around and discover where the local people eat. This is a great way to find authentic food at a budget-friendly price.

Learning how to properly manage your personal finances can be rather addicting. Always start with basic information and then expand on it. It’s likely that these tips will be able to save you a great deal of money. Adopt new habits and look for more ways to reduce your expenses, and place your money in good investments.