The beauty of bank cards is that people can use them to buy things without having to pay for them right away. Before signing up for a new credit card, you have to learn some basic things that will help you avoid mountains of debt. Continue reading this guide in order to get good credit card advice.

Check the details and fine print. If there are offers that allow you to be pre-approved for a card or if the person is saying you can be helped to get a card, you have to know the details before signing up. Details like the rate of interest you will have to pay often go unnoticed, then you will end up paying a very high fee. Remember to check out any grace periods and finance charges involved, too.

Credit Card

Always report any fraudulent charges that you notice on your credit cards as soon as possible. This will give the company a greater possibility of catching the perpetrator. Doing this also helps ensure that you will not have to pay for such charges. Any charges that you did not make need to be reported to your credit company with a phone call or a high priority email.

When you turn 18-years-old it is often not smart to rush to apply for a credit card, and charge things to it without knowing what you’re doing. While doing this is common, it’s a good idea to wait until a certain level of maturity and understanding can be gained. Get used to your responsibilities as an adult prior to dealing with a credit card.

When developing a PIN or a password, make it one that is hard to make any sort of guess about. For instance, using a loved one’s birth date or your middle name could make it easy for someone to guess your password.

No matter how tempting, never loan anyone your credit card. Even though a good friend might have a need, it is never a good decision to lend it to anyone. You may end up exceeding your credit limit and incurring charges if they make charges you were not expecting.

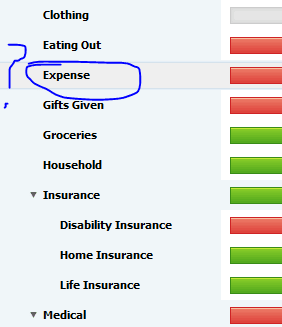

Keep track of your purchases made by credit card to make sure that you do not spend more than you can afford. It is easy to loose track of the money you spend when you use your card unless you make a commitment to keep track in a note book or spreadsheet.

Charge cards, if used responsibly, can be extremely helpful. Keeping yourself as debt free as possible and upholding a solid credit score is possible when you apply the tips from this article. When you accomplish this, your cards stay available to make purchases when you need to make them.