Jumping into stock investing can be a scary thing to do. There is so much to learn and alsoo, of course, a fear of losing money. The tricks in this guide will enable you to invest the right way to make a profit.

Keeping things simple can really be effective in life, and this applies very well to the stock market. Simplify your investment actions. Whether it is in examining past performance for prediction, or doing the actual trade, avoid over-complication of the process.

Stocks aren’t just a piece of paper! A stock represents your ownership of a piece of the company that issued it. You are entitled to the earnings from your stocks, as well as claims on assets. Sometimes you are allowed to vote in big elections concerning corporate leadership.

Prior to signing with a broker or using a trader, see what fees you’ll be liable for. Learn more about entry and exit fees before signing up. You’d be surprised how quickly these fees can add up.

If you are the owner of basic stocks you should be sure to utilize your right to vote as a shareholder. While each company differs, you may be able to vote for directors or for proposals that involve major changes like merging with another company. Voting normally happens during a company’s shareholder meeting or by mail through proxy voting.

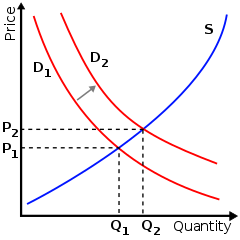

Choose the top stocks in multiple sectors to create a well-balanced portfolio. Even if the market, as a whole, is seeing gains, not every sector will grow every quarter. By having positions along many sectors, you can profit from growth in hot industries, which will expand your overall portfolio. By re-balancing your portfolio, you lessen your losses in smaller sectors while taking positions in them during their next growth cycle.

Try and get stocks that will net better than 10% annually, otherwise, simpler index funds will outperform you. To figure out the return that a particular stock is likely to deliver, all you need to do is add the dividend yield to the projected rate of earnings growth. For example, if the stock yields an 11% return and 1% dividends yearly it yields a total return of 12%.

It is a good idea to spread around your investments. You do not want to put all your eggs in one basket, as the saying goes. If you put all of your money into one stock, and then that stock crashes, you will be financially ruined.

Don’t try and time the markets. Research shows that patience pays off and slow and steady is the tried and true method for success in the world of stock. Just figure out how much of your personal income you are able to invest. You should adopt a regular pattern of investments, for instance once a week.

Do not invest a lot of money in stock of the company who employs you. It can be risky to own stock of the company that you work for. If your company begins to not do well, not only will your income be at risk, but so will your portfolio. If employee stock comes at a discount, however, it may be a good deal.

The article you just read was full of useful guidance regarding stock market investing. Just make sure that you do your research properly, and once you start investing some money, try to remain calm. By following the advice here, you will be well on your way to making money in no time!

If you’re targeting a portfolio based on maximum and long range yields, it is necessary that you purchase the strongest stocks coming from different industries. Though the market, as a whole, records gains in the aggregate, individual sectors will grow at different rates. Positioning yourself across different sectors gives you the ability to take advantage of all they have to offer. On a regular basis, reevaluate your investments so that you can reduce the impact of losses from declining industries and increase your position in the ones which are gaining.