If there are inaccuracies in your credit file, this can give you a poor credit score making it very difficult for any types of loans in the future. The most efficient way to fix your credit is doing it yourself. Read on to find out how you can fix your credit.

Develop a plan that works if you are in need of credit score repair. You must be dedicated to making some significant changes in the way you spend your money. If you don’t need something, don’t buy it. If the thing you’re looking at is not both necessary and within your budget, then put it back on the shelf and walk away.

Lower Interest Rates

If you’re credit needs some work, first you should make a plan you can stick with, and then follow through. You must be committed to making real changes in the way you spend money. Only the necessities can be purchased from here on in. Ensure that you can afford everything you buy and that you really need it.

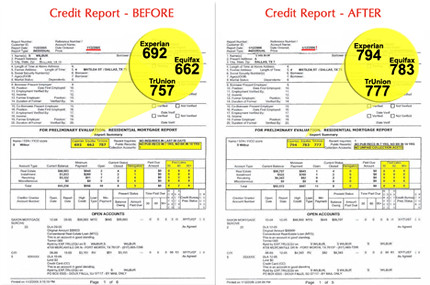

You can get better interest rates on credit cards and loans when you have a good credit score. Lower interest rates make paying bills easier, and prevents you from incurring debt. Obtaining lower interest rates will make it easier for you to manage your credit, which in turn will improve your credit rating.

When you have a good credit rating, you will be able to easily get a mortgage loan. Paying mortgage notes on time will keep your credit scores high. Owning your own home gives you a significant asset to use in securing your finances, and your credit score will reflect that asset. This will make taking out future loans much easier.

Repairing your credit is actually pretty simple. The first step is to focus on paying your late bills. More importantly, you need to start paying your bills in full and on time. Your credit rating will quickly rise as you settle up your overdue bills.

You can get a house mortgaged at the snap of a finger if you have a high credit score. One way to help improve your credit is to pay your monthly mortgage payments on time. Owning a home provides financial stability which is backed by your asset, the home, and as such, results in great credit. These benefits will pay off if you need to secure a loan.

As you can see, you have many options when it comes to repairing your credit. By following the suggestions contained in this article, an improvement in your credit score should not be too far away. Repairing your credit on your own can work, and it’s an excellent way of improving your record.