Are you frustrated when you think about your personal finances to the point where you feel out of control? This is commonly felt, and one can get rid of this feeling by following helpful advice. Here we will take a look at ways you can be back in charge of your financial life.

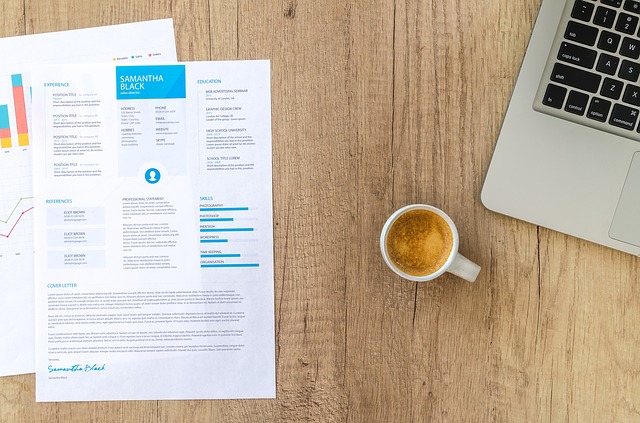

Proper budgeting is a huge part of being successful. Protect profits and invest capital. You can reinvest profit back into your company to build a greater foundation but make sure you clearly manage this money and keep clear records. Set aside a specific percentage of profits earned, and invest the rest in capital that can make you even more profit.

Wait until it’s a good time to sell. Leave your stocks alone if you’re earning money on them. If you have stocks in your portfolio that are not performing well, you may wish to change them up a bit.

You should follow the trend. If you do not stay current with the market, you will not know when to buy low or sell high. When the prices are in mid-swing, avoid selling. Have a very clear goal in mind if you are choosing to move your money before the trend has fully played out.

Develop a better plan for the future by keeping a journal of all of your expenditures. Simply jotting down your expenditures in a notebook may make it easier to avoid confronting them by pushing them to the back of your mind. Try listing your expenditures on a large whiteboard in your office or bedroom instead. By seeing it frequently, you will be reminded to stay faithful to it.

Are you married? Let your spouse apply for loans if he or she has a better credit score than you. If you currently have a bad credit rating, take some time to improve it by using a credit card and paying it off on time. Once you have both improved your credit scores, you can share the debt responsibility for future loans.

To be truly financially stable, you should have a good deal of savings. If you do not have much saved up yet, open a savings account and get the ball rolling. This way you might not have to apply for a loan when you need money, and also you will be able to face most unforeseen events. Contribute what you can every month, even if it is very small.

Consider eating local foods to try to save money when visiting a foreign country. Hotel restaurants should only be your last resort. Do some online research, or ask around, and find some great local places to eat. Food that is higher in quality and lower in price can always be found.

As stated earlier, it is very frustrating to have no control over your finances. If you get the right advice and keep your options open, you will not have any trouble getting your finances back into shape. Use the tips in the above article to get yourself financially on track.