Bank cards help individuals all around the world to achieve their lifestyle goals. Having one gives an individual increased financial freedom. That being said, it’s crucial that you select a credit card with care, and make purchases wisely. In the following paragraphs, you’ll find essential tips on using your charge cards responsibly.

Immediately report any fraudulent charges on a credit card. By doing this, you can help your credit card company catch the thief who is making these unauthorized charges. Also, by notifying the credit card company immediately, you can ensure that you aren’t in any way responsible for the charges. If you suspect fraudulent charges, immediately notify the company your credit card is through.

Before you ever use a new credit card, it is important to carefully read through all of the terms of the credit card agreement. Most credit card providers will consider you using your card to make a transaction as a formal agreement to the terms and conditions of their policies. Although some of this agreement may be in fine print, it is very important to thoroughly read all sections.

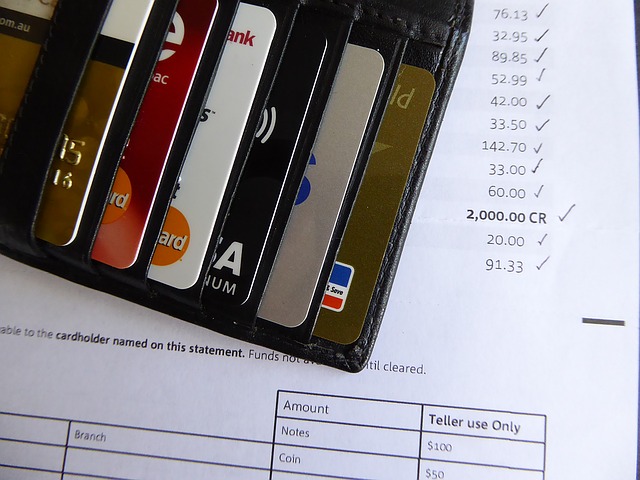

It is wise to have two or three different credit cards available for your use. You will improve your credit score. Paying off all of your cards monthly helps even more. Having tons and tons of credit cards, however, will not look very good to lenders.

Completely Understand

Make sure to completely understand your credit card terms before signing up with one. It is possible to discover rates that are higher than you expected. Read each word in the fine print so that you completely understand their policy.

It is not a good idea to get a credit card right when you turn of age. Though this is commonly done, it is important to educate yourself thoroughly on bank cards before jumping in. Spend a few months just being an adult before applying for your very first credit card.

If you are having hard times financially, be sure to inform the credit card company. If you are unsure whether you will make a payment, your company might work to create a payment plan that is adjusted for you. This could prevent them from sending late payments to the large reporting agencies.

Many credit cards offer loyalty programs. You should find a rewards program that will benefit you for regular usage of your card. This can provide you with extra income, airfare, or other rewards, if you use the card wisely.

Never use a credit card to buy things you can’t afford. Credit cards should not be used to buy things that you want, but don’t have the money to pay for. You will be paying much more than the initial cost due to interest. Leave the store and return the next day if you still want to buy the product. If you still plan to buy it, the store’s in-house financing usually offers lower interest rates.

Blank Space

Keep tabs on your credit score periodically. A score of 700 is what credit companies feel the limit should be when they consider it a good credit score. Use credit cards in a smart way to keep that level of credit or to reach it. Once your score hits 700 or above, you will get all the best offers of credit with the lowest interest rates.

When signing a credit cards receipt, make sure you do not leave a blank space on the receipt. Having a blank space on your receipt is literally leaving space for someone to add an amount where you don’t want it. Be sure to mark through the space with a straight line. You should also always check your statement against your receipts every month to ensure they match up.

Charge cards can offer a lot of advantages, enlarge spending options and provide a wealthier lifestyle to people. When credit is used correctly it can become a great asset, but incorrect use will cause the consumer to experience credit misery. The information provided here can assist people in making smart credit card choices that will enable them to live a better life.