Having poor credit can be a devastating occurrence in life. It can take take away choices and stop you from enjoying wonderful opportunities. You can repair it though, and make steps to prevent it from spiraling down further.

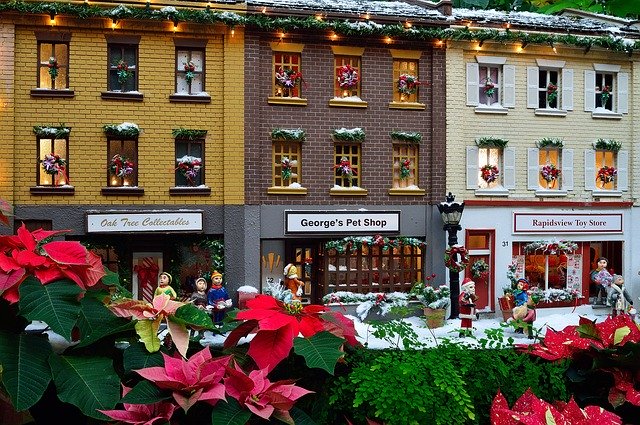

Credit Card

There are secured credit cards available if your credit rating is too low to open up a regular credit card account. Most likely, you will not have a problem obtaining this type of card, but you must add funds to the account before you make any purchases to assure the bank that you will pay. Responsible use of any credit card can help your credit rating. However, never forget that irresponsible use will get you in trouble every time.

If you have to improve your credit, make a solid plan and follow it. You can’t just make up a plan and not change how you spend your money. Purchase nothing but the essentials. Ensure that you can afford everything you buy and that you really need it.

Good credit scores mean you can easily qualify for a home or car loan. If you pay your mortgage as agreed, your credit score will rocket into the stratosphere. Home ownership also means you have assets that you can rely on to increase your credit score. Financial stability is important should you need a loan.

When you are trying to clear up your credit contact your credit companies. If you do this you’ll find that your debt doesn’t increase and your credit is improved. You can accomplish this by simply calling and asking them to change payment terms, like your interest rate or your billing date.

Contact your creditors to request a reduction in your credit line. This is likely to keep you from overusing credit, which can be a financial burden. It also lets credit card companies know that you are responsible, and this makes them more likely to extend credit to you as time goes on.

Try to keep a balance of less than 50% of your available credit on all of your cards. If you let your balances get too high, your credit rating will drop significantly. You can either spread your debt out by transferring some of the balance to low interest cards, or better yet, pay off as much as you can.

Make sure to check all three of your credit reports, and pay extra attention to the negative reports when you are working on repairing bad credit. The debt itself may be legitimate, but if you find errors in its metadata (e.g. the date, amount, creditor name), you might be able to get the whole entry deleted.

Easy tips, like the ones in this article, will help you repair your credit and keep it healthy in the future. Credit rating affects your life in many ways, so make sure to learn all you can about it.