Bad credit hurts you in nearly all your financial dealings, especially those that involve extending credit to you. Negative credit can affect your future. It is possible to repair the credit, however, and you will start to see doors reopening. Here are some suggestions on fixing your credit rating.

The first step to repairing your ailing credit is to create a manageable, feasible financial plan. You must be dedicated to making some significant changes in the way you spend your money. Sticking to necessities for a while is crucial. Put each potential purchase to the test: is it within your means and is it something that you really need?

If you can’t get a normal card due to low credit score, look into a secured card. When you open a secured credit card account, you place money on deposit to cover any charges you may make. This ensures in advance that you will have enough money to pay for your debt. Even though this card will be secured by your own money, you will make payments and manage it as if it were unsecured. This will improve your credit as you show yourself able to make the payments on time.

Getting a traditional home loan can be difficult, if not impossible, with imperfect credit. If possible, apply for an FHA loan; these loans are backed by the United States government. FHA loans even apply for someone who doesn’t have closing costs or the funds that are needed for down payment.

Credit Score

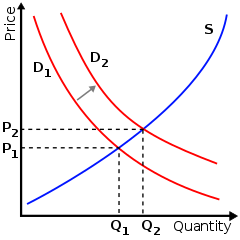

You will be able to get a lower interest rate if you keep your personal credit score low. This allows you to eliminate debt by making monthly payments more manageable. Try to get the best offer and credit rates so you can increase your credit score.

You can dispute inflated interest rates if you are being charged more than you should be. When a creditor hits you with incredibly high interest rates, you may have a case for negotiating to a lower amount. However, you signed a contract agreeing to pay off interests. It is possible that you can sue a creditor and claim that the interest rate charged is unreasonably high.

If you need a credit card to aid in fixing your credit but you cannot obtain one due to the state of your credit, applying for a secured credit card is an option. With a secured card, you have to fund your account before you use the card so that the bank will be assured that you will pay off your debts. If you show a good history of payments with this card, it will help improve your credit standing.

The first step to repairing your credit is paying what you owe. Paying your bills on time and for the full amount is important. Once you have started to pay towards your past-due accounts, you credit score will gradually improve.

Repair your negative credit to open up more opportunities in the future. There are instructional courses often offered free of charge to help you repair your credit. Apply what you have learned from this article, and begin your journey toward better credit.